Building smart

money habits for life

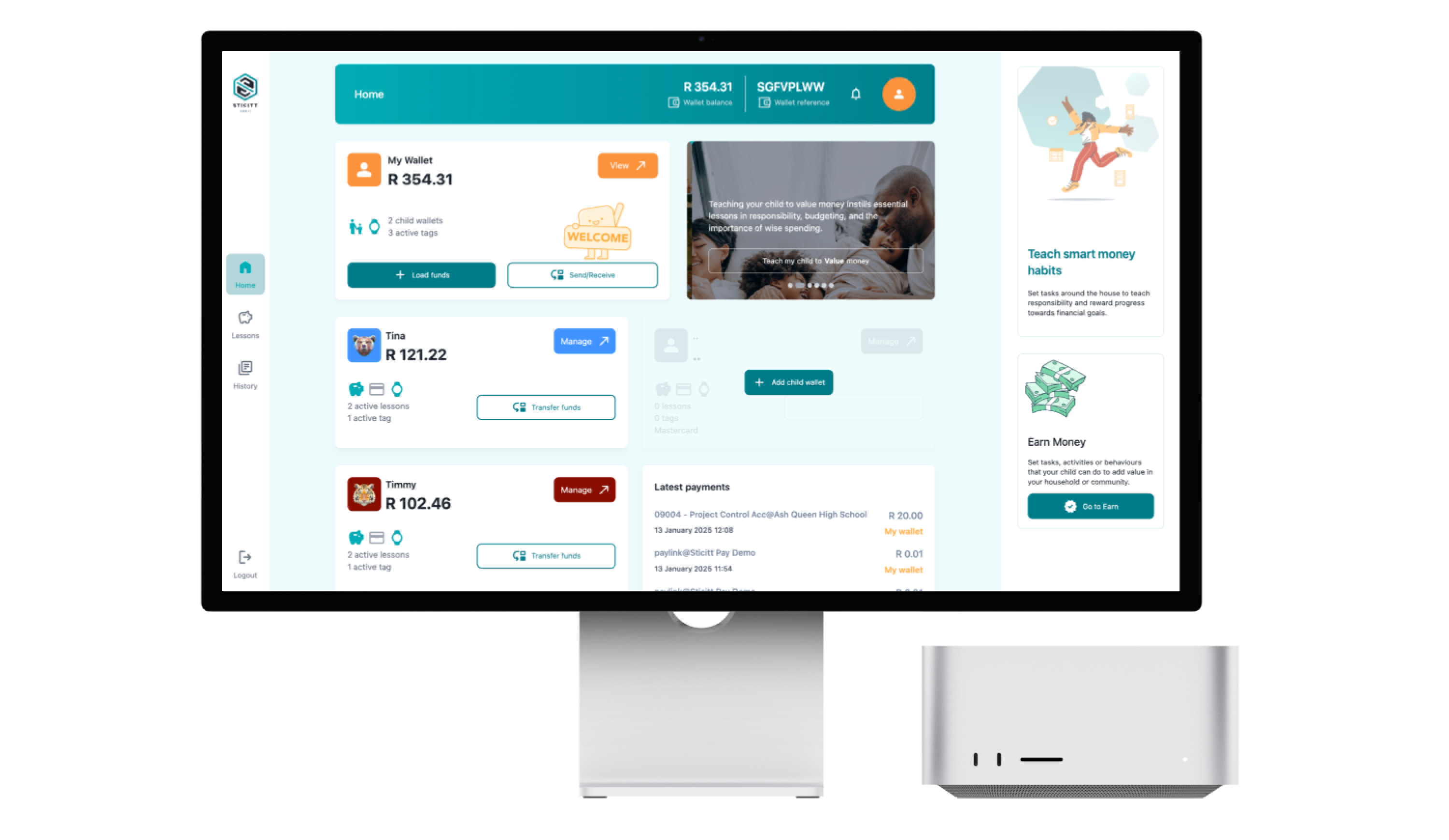

Embark on a transformative journey with us as we empower you to craft the future you’ve always envisioned. In a world where money is often misunderstood and misaligned to our needs, we aim to raise the next generation of financially enabled children. At Sticitt, we believe financial literacy starts young. Our Money Habits empower kids with the knowledge and confidence to make smart money choices, helping them save, spend, and plan wisely for life.

Interactive tools tailored for your guidance and their success.

Earn

We believe it is important that children learn from a small age where money comes from. So instead of just giving them money at will, set the optional tasks, activities or behaviours that they can do to add value in your household or community and transfer money for adding value.

Budget

Planning ahead is a crucial life skill, especially when it comes to money. With our Budget Habit, you can help your child create a spending plan, track their progress, empower them to think ahead, make intentional choices, and develop the discipline to stick to their budget—setting them up for a lifetime of financial confidence.

Save

Saving is more than just putting money aside—it’s about learning patience, goal-setting, and making thoughtful financial choices. By encouraging your child to save, you help them understand the value of money and the rewards of delayed gratification. With our Savings Habit, they can set goals, track their progress, and experience the excitement of reaching their targets.

Value

Our Value Habit encourages kids to reflect on their past spending, helping them assess whether their purchases were worth it. This reflection builds a deeper understanding of money and encourages thoughtful spending. Over time, this habit fosters a sense of responsibility and builds a foundation of making smarter financial decisions throughout their lives.

Invest

Encourage your child to invest for a secure financial future while teaching critical thinking and patience. With our Invest Habit, kids can set their own earning goals and track how much they need to save to reach them. Interest is paid by the parent or guardian, giving you a way to motivate and teach children about smart money management by paying a return on investment instead of an allowance they haven’t earned.

Share

Our Share Habit teaches kids the value of generosity and responsible giving, helping them grow into compassionate and financially savvy individuals. By learning to share their money thoughtfully, children develop a sense of empathy, community, and financial responsibility. This habit not only encourages kindness but also helps them understand the impact of their financial choices, setting them up to make meaningful contributions as they grow.

We offer more than just Money Habits –

Powerful tools for Premium Parents

- Set daily limits on spending

- Let your child spend at the tuckshop without cash

- Get notifications when children spend or if funds run out

- Instantly load more funds if they forget their lunch

- Monitor how much is spent at the tuckshop

- Give each child a separate wallet, still under your control

- Let children track their own money, learn to budget, save, and make smarter spending choices

- Teach your child to earn money by adding allowances or rewards for completing tasks

- Disable features on your child’s wallet

- Invite your spouse to help you manage their financial behaviour